Defining the Method of Calculating Indirect Costs

Aug 15, 2014 21331 Print this page Download PDF Request support

Related articles: Understanding the Budget Calculation

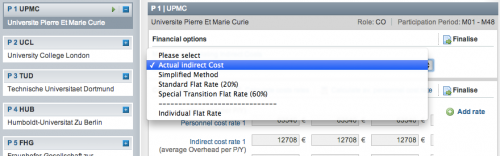

Depending on the selected funding scheme and the contractor’s organisation type, you can choose different methods for calculating the indirect cost at Proposal > Contractor > Financial Information or DoW > Contractor > Financial Information in the panel Financial Options.

Please verify with the funding programme guidelines to understand which methods for calculating the indirect cost apply for your organisation type. Here are some general guidelines:

You can set only one method per partner for calculating the indirects cost of the partner. There are 2 options to calculate the indirect costs:

- Actual Indirect Costs or Simplified Method (an indirect cost rate per personnel cost category for each person-month planned)

- Flat rate calculation e.g. 25 of all direct costs except sub-contracting

Actual Indirect Costs or Simplified Method

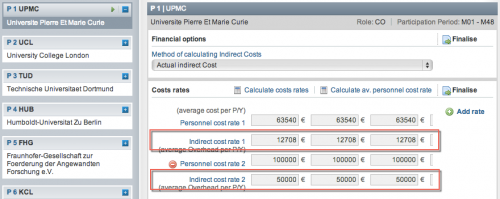

If your accounting system identifies the indirect costs as being incurred in direct relationship with the eligible direct costs attributed to the project, choose one of the two following methods of calculating indirect costs from the drop-down menu Method of Calculating Indirect Costs.

- Actual Indirect Costs (FP7 and H2020 only)

- Simplified Method (FP7 only)

For those methods, EMDESK will display additional input fields “Indirect cost rate X” per each personnel cost category X for the indication of the indirect cost rate per each personnel cost category in the panel Cost Rates. Enter indirect cost rates per each project year (not calendar year) in €/PY (EURO per person-year) and with dot as decimal separator e.g. 130233.42.

To understand how indirect costs are calculated using this method, please section Indirect Costs in the article Understanding the Budget Calculation.

Flat rate calculation

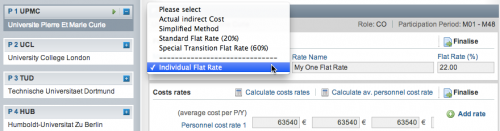

For a flat rate calculation of indirect costs, please choose one of the predefined flat rate options from the drop-down menu Method of Calculating Indirect Costs:

- 25% Flatrate for indirect costs (FP7 and H2020 only)

- Standard Flat Rate (20%) (FP7 only)

- Special Transition Flat Rate (FP7 only)

- Individual Flat Rate: If you want to define a specific percent flat rate, please choose Individual Flat Rate. An input field on the right side of the drop-down menu appears. Please enter a name and the percentage for calculating the indirect costs.

For further information on how the indirect costs are calculated, please read Understanding the Budget Calculation.

Related Articles

-

Planning Direct Costs (other than Personnel Costs)

August, 19 2014 4

-

Understanding the Budget Calculation

January, 1 2013 9

-

Budget vs. Actual Costs Controlling

October, 13 2012 4